Until Wednesday evening, financial analysts were waiting eagerly for Nvidia's quarterly results. It's been a remarkable few years for the chip manufacturer, with rapid growth fuelled by AI demand for its chips.

The company's stock has risen by 900% since the start of 2023, when AI hype began its meteoric rise with the arrival of ChatGPT the previous November. Nvidia also became the world's most valuable company, for one day in June 2024, when it was valued at $3.3 trillion.

It's latest results were above market expectations, but on Thursday it slid into the red. What is going on?

Nvidia's stock has risen from around $14.60 per share since the beginning of 2023 to over $120 now.

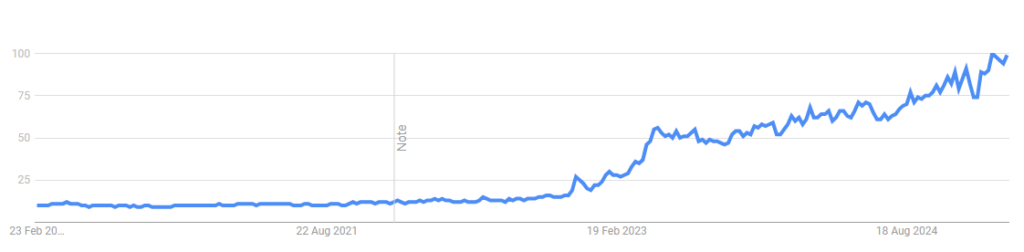

Global Google Trends data for 'AI' shows a correlation with Nvidia's stock rise, similarly increasing nearly 10x since early 2023.

GPUs: Integral for gaming, vital for AI

Nvidia's breakneck growth has been powered by its deep expertise in manufacturing GPUs (Graphics Processing Unit, the main component of graphics cards) for PCs, particularly for gaming.

The company first released GeForce 256 in 1999, which is credited with defining the modern GPU, and the company's chips have become integral to PCs since. In 2009, Nvidia held around 50% in GPU market share. In 2024 this was closer to 90%.

In 2006, Nvidia launched the CUDA (Compute Device Architecture) platform, which enabled developers to use GPUs for general-purpose computing. This opened up the massively parallel processing power of GPUs to scientific research and other fields.

In the 2010s, researchers found that GPUs were very well suited for training deep neural networks, which require massive amounts of parallel computation. The parallel processing that made GPUs great for rendering graphics also made them ideal for the calculations needed for AI.

Nvidia GPUs were used to power AlexNet, a neural network that won a very important image recognition contest in 2012, this event greatly accelerated the use of GPUs in AI.

Nvidia CEO Jensen Huang foresaw that Artificial Intelligence was reaching a tipping point due to advances in computing power, and thus doubled down on AI focused chips. Tensor Cores were launched in 2017 (one year before the first Generative Pre-trained Transformer - or GPT - arrived).

In his keynote speech at CES in January 2025, Huang pointed out how integral GeForce, and indeed gaming development, had been in the creation of generative AI. Likewise, he has previously pointed out this synergy in vice versa.

We can't do computer graphics anymore without artificial intelligence.

Jensen Huang, CEO of Nvidia

The Generative AI boom

Nvidia’s dominant position in GPU market share has been amplified by some huge investments in its products to power AI infrastructure. Some of the biggest recent announcements include:

$500bn for the Stargate project over the next five years, for which Oracle and Nvidia will be technology partners for OpenAI.

Microsoft intends to spend $80bn on AI infrastructure during 2025.

Meta has committed another $65bn, possibly rising to as much as $200bn.

These are gigantic numbers, and Nvidia will provided GPUs for each project. Its sales over the last few years illustrate the growing demand:

2022 - $26.914B, a 61.4% increase from 2021.

2023 - $26.974B, a 0.22% increase from 2022.

2024 - $60.922B, a 125.85% increase from 2023.

2025 - $130.5bn, a 114% increase from 2024.

Note that Nvidia’s annual results are released in January - thus ‘2025’ is really the performance over the past year (which this year is 2024).

While Nvidia’s earnings did beat market expectations on Wednesday, estimates for Q1 gross margin were below expectations, and the stock sank -8% on Thursday.

The stock has declined in 2025, perhaps signalling the top, at least for now, of AI hype. In late January it was hit by the sudden rise of DeepSeek, leading to $579 bn being wiped off its value on 27 January.

The DeepSeek developers managed to develop a foundation model comparable to OpenAI's, without access to Nvidia’s best chips. This has led some investors to question whether massive AI infrastructure investments are necessary, and thus whether Nvidia’s breakneck growth remains sustainable.

In the short term, the company will almost certainly continue growing - but whether AI development will rely so heavily on Nvidia’s GPUs in the long term remains to be seen. As DeepSeek’s sudden arrival hinted at - there could be another way.